The Carbon Market, a Green Economy Growth Tool!

Assessment of the operating parameters of the Cap-and-Trade System

The Ministère de l’Environnement, de la Lutte contre les changements climatiques, de la Faune et des Parcs (MELCCFP) and the California Air Resources Board (CARB) are currently assessing possible adjustments that may be made to the Regulation respecting a Cap-and-Trade System for greenhouse gas emission allowances (Regulation). Webcasts were held to discuss the possible adjustments, with the aim of presenting a draft regulatory amendment in 2024.

For further information or to access related documents, see the page Assessment of the operating parameters of the Cap-and-Trade System.

C&T System Details

- Mandatory Reporting of Certain Emissions of Contaminants into the Atmosphere

- C&T System Registration

- Opt-in

- Allocation of Emission Units without Charge

- Auctions

- Sales by Mutual Agreement by the Minister

- Offset Credits

- Early Reduction Credits

- Emission Allowance Transfers

- Accounting of Compliance Instruments Traded among WCI Linked Jurisdictions

- Compliance

- Publication and Forms

- Join Us

Putting a price on carbon is a mechanism used to regulate greenhouse gas (GHG) emissions in the fight against climate change. The aim is to encourage companies and citizens to innovate and change their behavior in order to reduce GHG emissions.

In 2013, Québec set up a Cap-and-Trade System for greenhouse gas emission allowances (C&T system) to fight climate change. In 2014, Québec linked its system to California’s, thereby creating the largest carbon market in North America and the first to be designed and managed by sub-national governments in different countries.

This carbon market is a green fiscal tool that simultaneously allows for reducing GHG emissions and developing strategic sectors for the Québec economy (clean technology, energy efficiency, transportation electrification, etc.).

- The actors involved in the C&T system

- How the C&T system works

- Reinvesting revenues in Quebec's fight against climate change

- The value of an emission allowance

- The contribution of the joint Quebec-California carbon market to meeting GHG emission reduction targets

- Learn more

The actors involved in the C&T system

The carbon market is intended for the following companies (the emitters):

- Industrial establishments that emit 25,000 metric tons of CO2 equivalent (mt CO2 eq.) or more annually (aluminum smelters, cement plants, refineries, chemical plants, steel mills, mines, etc.);

- Electricity producers and importers, for which the GHG emissions associated to the production of electricity equal or exceed 25,000 metric tons of CO2 equivalent annually;

- Distributors of fuels used in Québec (gasoline, diesel fuel, propane, butane, kerosene, coal coke, petroleum coke, coal, distillation gas, ethanol, biodiesel, biomethane, natural gas, and heating oil).

- Distributors are required to cover the GHG emissions resulting from the products they distribute;

- Industrial establishments that report annual emissions equal to or greater than 10,000 mt CO2 eq. but less than the threshold of 25,000 mt CO2 eq. wishing to become an emitter subject to the C&T system.

Requiring these companies to be subject to the C&T system ensures coverage of approximately 80% of GHGs emitted in Québec.

Potential emitters, or newly covered emitters are invited to consult the document Implication of Being Subject to the C&T System (![]() PDF, 451 KB). This document contains a summary of the information on compliance, emissions coverage, the purchase of emission allowances and the impact of the carbon cost on fuels.

PDF, 451 KB). This document contains a summary of the information on compliance, emissions coverage, the purchase of emission allowances and the impact of the carbon cost on fuels.

The carbon market is also accessible to natural and legal persons who wish to participate (the participants) such as investors, brokers, consultants, offset credits promoters, etc.

Links:

- List of emitters and participants registered to the carbon market

- Types of participants in the C&T system

- C&T system registration

- Opt-in

How the C&T system works

SPEDE consists of several components. Here are the main ones:

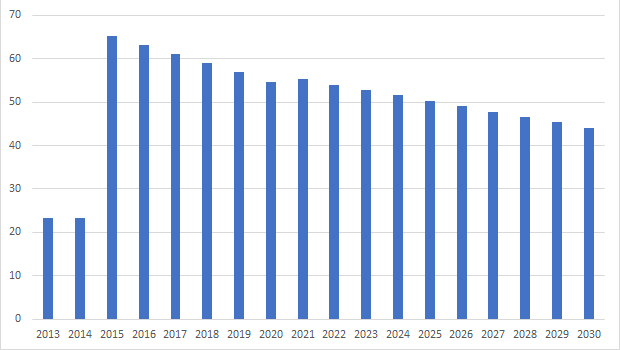

Caps

The government sets a cap on the number of emissions units it will put into circulation each year, thus limiting GHG emissions for the sectors covered over a given period. This cap gradually is progressively reduced over time, encouraging emission reductions.

Emission Caps

(in million emission units)

Links:

- Caps for the 2013-2020 period - Order in Council 1185-2012 (

PDF, 149 ko)

PDF, 149 ko) - Caps for the 2021-2030 period - Order in Council 1126-2017 (

PDF, 57 ko)

PDF, 57 ko)

Compliance

At the end of each three-year compliance period, emitters must obtain an emission allowance (a term that refers to both emission units and offset credits) for each ton of GHGs they release into the atmosphere and surrender them to the government. They must surrender enough allowances to cover their emissions, or penalties will apply.

The C&T system requires rigorous annual quantification of GHG emissions. Verification mechanisms are also defined, including the obligation for all emitters subject to the C&T system to have their annual declaration verified by an accredited independent organization.

Links:

Buying emission allowances

- The government holds emission units auctions four times a year. Only emitters and participants registered to the market can participate in these auctions.

- Emitters that are exposed to national and international competition receive a certain amount of GHG emission units without charge. The number of free units allocated drops progressively over time to encourage emitters to make additional efforts to reduce their GHG emissions. The allocation of free emission units is a C&T system mechanism designed to help maintain the competitiveness of companies and avoid “carbon leakage”.

- Emitters that are able to reduce their GHG emissions below the number of units they have been allocated without charge (for example, by improving their production efficiency or adopting cleaner less polluting green technologies) can sell the surplus emission units on the carbon market to other emitters whose GHG emissions have exceeded their allocation.

- The government also allows emitters to cover a part of their GHG emissions by using offset credits.

- In addition to auctions, the government may also hold a sale by mutual agreement by the Minister. These sales are reserved for Québec emitters who have an account in the CITSS system and whose general account does not contain enough emission allowances to cover their emissions for the compliance period for which the sale is being organized.

- Emitters also have the option of purchasing emission allowances from other participating companies.

Links:

- Auctions

- Sale by mutual agreement by the Minister

- Allocation of emission units without charge

- Offset credits

- Emission allowance transfer

Enforcement

Various means are available to the Minister for enforcing Québec’s Regulation respecting a cap-and-trade system for greenhouse gas emission allowances. Whenever a regulatory infraction is detected, either following an inspection or by the administrative authority (for example, when required action is not taken within the allotted time or when mandatory information is missing, erroneous or misleading), a notice of non-compliance is sent to the offender. The notice stipulates that the infraction may lead to the imposition of a monetary administrative penalty and penal proceedings.

Specific administrative measures are also provided for such as:

- 3 emission units or early reduction credits for each missing emission allowance needed to complete the coverage

- Suspension of emission units allocated without charge

- Refusal of registration for auction sale or sale by mutual agreement

- Suspension, withdrawal or cancellation of emission allowances granted

- Suspension of electronic system access or account

Links:

- Monetary administrative penalties (French)

Reinvesting revenues in Quebec's fight against climate change

Québec has chosen to fully allocate proceeds from carbon market auctions into the Electrification and Climate Change Fund (French). These revenues finances the measures outlined in the 2030 Plan for a Green Economy as well as ongoing commitments made under the 2013-2020 Climate Change Action Plan. With this funding, Quebec is taking concrete action to achieve its environmental objectives, while promoting the development of a sustainable economy that is resilient in the face of climate challenges. It also enables the government to support companies, municipalities and citizens in reducing GHG emissions and adapting to the impacts of climate change.

Links:

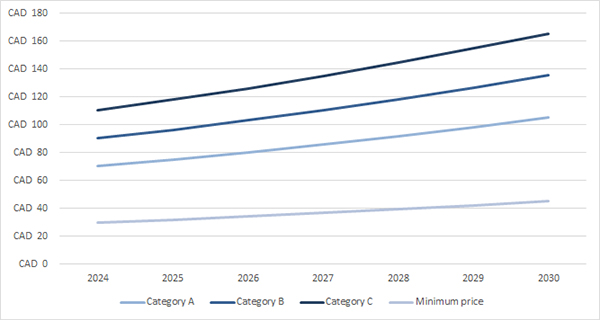

The value of an emission allowance

Determining a precise value for an emission allowance is impossible, as it is influenced by supply and demand on the carbon market. However, certain parameters enable to estimate a price range for these allowances.

First, there is the annual auction minimum price for the current vintage. This minimum price establishes a limit below which emission allowances cannot be sold. On the other hand, there is also a maximum price which corresponds to the price of Category C units, the category with the highest prices. This maximum price gives an indication of the upper limit that emission allowances could reach in the coming years.

It is important to note that the value of emission allowances can vary over time in response to economic conditions, government policies, technological advances and environmental objectives. As a result, the price range for emission allowances may fluctuate in response to these factors.

Potential evolution of the price of an emission allowance

Assumptions: Long-term inflation rate (rate that the Bank of Canada aims to keep) of 2% and an exchange rate of 1.2500 from 2024 through 2030.

This price scenario is presented as an example only. Estimates depend on the underlying assumptions and should not be considered as a market price forecast. It is important to use this information with caution.

This carbon price has an impact on the prices of fuels sold in Quebec. Referring to the minimum and maximum prices mentioned above, the table below shows the potential impact of the carbon price on different fuels for each year up to 2030.

Impact of carbon price (in cents per liter or per m3) on fuels prices as a function of the potential evolution of the minimum and maximum prices

| 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | |

| Automotive gasoline | Min: 7.1 - Max: 26.1 |

Min: 7.6 - Max: 28.0 |

Min: 8.2 - Max: 29.9 |

Min: 8.7 - Max: 32.0 |

Min: 9.3 - Max: 34.3 |

Min: 10.0 - Max: 36.7 |

Min: 10.7 - Max: 39.2 |

| Diesel fuels | Min: 9.0 - Max: 33.0 |

Min: 9.6 - Max: 35.3 |

Min: 10.3 - Max: 37.8 |

Min: 11.0 - Max: 40.5 |

Min: 11.8 - Max: 43.3 |

Min: 12.6 - Max: 46.3 |

Min: 13.5 - Max: 49.9 |

| Light oil | Min: 8.2 - Max: 30.2 |

Min: 8.8 - Max: 32.3 |

Min: 9.4 - Max: 34.5 |

Min: 10.1 - Max: 36.9 |

Min: 10.8 - Max: 39.5 |

Min: 11.5 - Max: 42.3 |

Min: 12.3 - Max: 45.3 |

| Heavy oil | Min: 9.5 - Max: 34.7 |

Min: 10.1 - Max: 37.1 |

Min: 10.8 - Max: 39.7 |

Min: 11.6 - Max: 42.5 |

Min: 12.4 - Max: 45.5 |

Min: 13.3 - Max: 48.7 |

Min: 14.2 - Max: 52.1 |

| Propane | Min: 4.6 - Max: 17.0 |

Min: 5.0 - Max: 18.2 |

Min: 5.3 - Max: 19.5 |

Min: 5.7 - Max: 20.8 |

Min: 6.1 - Max: 22.3 |

Min: 6.5 - Max: 23.9 |

Min: 7.0 - Max: 25.5 |

| Natural gas | Min: 5.7 - Max: 20.8 |

Min: 6.1 - Max: 22.3 |

Min: 6.5 - Max: 23.9 |

Min: 7.0 - Max: 25.5 |

Min: 7.4 - Max: 27.3 |

Min: 8.0 - Max: 29.2 |

Min: 8.5 - Max: 31.3 |

These prices are calculated using the emission factors shown in Table 30-1 of the Regulation respecting the mandatory reporting of certain emissions of contaminants into the atmosphere as of April 1st, 2022. These emission factors indicate the quantity of CO2 emitted when a given fuel is consumed.

Links:

The contribution of the joint Quebec-California carbon market to meeting GHG emission reduction targets

In 2014, Quebec linked its system to California's as part of the Western Climate Initiative. Compliance instruments are traded and used interchangeably in both systems. An accounting mechanism has been developed by Quebec and California. Achievement of Quebec's GHG emissions reduction target is thus assessed not only through the Quebec GHG emissions inventory, but also by taking into account emission allowances trading between Quebec and California.

Links: